In the vast and deeply interconnected world of enterprise technology, no single software vendor, not even the largest and most comprehensive platform giant, can be a self-sufficient island; strategic partnerships and alliances are the fundamental operating system of the entire industry. A deep analysis of Enterprise Software Market Partnerships & Alliances reveals that a vendor's success is critically dependent on the strength, breadth, and quality of its partner ecosystem. These collaborations, which span a massive global network of system integrators (SIs), thousands of independent software vendors (ISVs), and deep technical alliances with cloud infrastructure providers, are the primary mechanism for selling, implementing, customizing, and extending the value of enterprise software. The market's immense scale and complexity make this ecosystem approach an absolute necessity. The Enterprise Software Market size is projected to grow USD 1153.28 Billion by 2035, exhibiting a CAGR of 10.02% during the forecast period 2025-2035. To compete effectively, enterprise software vendors must be masters of ecosystem management, recognizing that their platform's success is inextricably linked to the success of their partners.

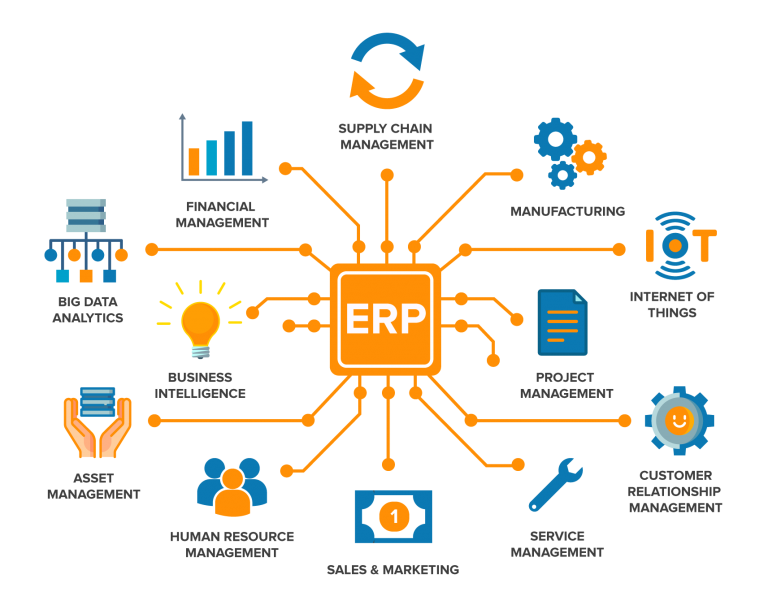

The most powerful and influential partnerships in the enterprise software market are the strategic alliances between the software vendors (like SAP, Oracle, and Salesforce) and the major global system integrators and consulting firms (like Accenture, Deloitte, PwC, and Capgemini). These SIs are the "implementation army" of the enterprise software world. Implementing a new ERP or CRM system at a large corporation is a massive, multi-year business transformation project, not a simple software installation. The SIs provide the vast teams of consultants, project managers, and technical experts needed to manage this complexity. The software vendors invest hundreds of millions of dollars in these partnerships, training and certifying tens of thousands of SI consultants on their platforms. This creates a powerful symbiotic relationship: the SI gets a massive pipeline of high-margin implementation work, and the software vendor gets a massive, highly-skilled, and trusted global sales channel. A strong recommendation from a major SI is often the deciding factor in a multi-million-dollar enterprise software deal, making the "battle for the SI" a key competitive front.

Beyond the vital SI alliances, another critical layer of partnership is with the vast ecosystem of Independent Software Vendors (ISVs). The leading enterprise platforms, most notably Salesforce with its AppExchange, have built thriving "app store" marketplaces where thousands of other software companies can build and sell specialized applications that extend the functionality of the core platform. For example, an ISV might build a specialized application for the construction industry that integrates with and runs on the Salesforce platform. This is a win-win-win strategy. The customer gets access to a wide range of pre-integrated, niche solutions. The ISV gets access to the massive distribution channel and customer base of the major platform. And the platform vendor (Salesforce) benefits because a rich ecosystem of third-party apps makes its own core platform more valuable and "sticky." Other key partnerships include deep technical alliances with the major cloud infrastructure providers (AWS, Azure, GCP) to ensure their software runs optimally on these platforms, and partnerships with a global network of smaller, regional Value-Added Resellers (VARs) to reach the mid-market and SMB segments.

Top Trending Reports -

GCC Relational Database Market